Social proof is a powerful psychological tactic scammers use to deceive investors, giving fraudulent broker schemes credibility and authority. According to a recent report by the FCA, nearly 60% of scam victims were influenced by fake testimonials and misleading social proof. This guide details how scammers manipulate social proof, and how you can protect yourself from becoming their next victim.

What is Social Proof and How Do Scammers Exploit It?

Social proof is the psychological phenomenon where people mimic the actions of others, assuming those actions are correct. Scammers create fake testimonials, reviews, and endorsements to build trust rapidly, persuading investors to deposit funds without careful consideration.

Common Ways Scammers Fake Social Proof

1. Fake Testimonials

Scammers often publish fabricated success stories or positive client feedback.

Example: Websites featuring excessively positive testimonials with generic names like “John D.” without verifiable identities.

2. Fabricated Endorsements and Certifications

Fake claims of regulatory approvals or professional endorsements.

Example: Displaying fabricated FCA or FINRA logos without actual regulatory oversight. Always verify via FCA Register or FINRA BrokerCheck.

3. Social Media Influencer Promotions

Paid influencers or fake social media accounts promoting fraudulent brokers.

Example: Instagram or TikTok influencers promoting “easy wealth” trading platforms. Always confirm authenticity through third-party verification before investing.

4. Fake Success Stories & Case Studies

Manufactured success stories posted on scam websites to convince potential investors.

Example: Websites claiming exaggerated investor success, such as “Turned $1,000 into $50,000 within a month.”

4. Fake Expert Profiles

Creation of fraudulent LinkedIn or social media profiles claiming industry experience.

Example: “Investment expert” profiles on LinkedIn with stolen or fabricated credentials.

How to Protect Yourself from Fake Social Proof

- Always Verify Information: Check reviews and testimonials through independent, reputable sources.

- Cross-Check Regulatory Claims: Verify broker credentials through official regulatory databases like ASIC, FCA, or SEC.

- Use Reverse Image Searches: Check images from testimonials or expert profiles on Google Reverse Image Search to detect stock photos or fake identities.

- Question Unrealistic Claims: Any overly positive, exaggerated claims should be treated skeptically.

What to Do if You’ve Been Fooled by Fake Social Proof

- Immediately document all interactions and evidence (screenshots, emails, and transactions).

- File complaints with relevant financial authorities such as:

- Initiate a chargeback through your financial institution.

- Consider professional recovery assistance for optimal recovery outcomes.

Frequently Asked Questions (FAQs)

How can I check if a broker’s testimonials are real?

Always independently verify through trusted review sites and regulatory databases. Avoid relying solely on broker-provided reviews or testimonials.

Are influencer endorsements always fraudulent?

No, not always—but verify legitimacy through independent research, and be cautious if financial compensation or affiliation isn’t disclosed clearly.

Can scammers create fake profiles on trusted platforms like LinkedIn?

Yes, scammers commonly create fake professional profiles. Verify credentials through external sources or direct contact with affiliated companies.

What should I do if I discover fake social proof after investing?

Immediately document everything, initiate a chargeback, and report the broker to regulators such as FCA or SEC.

Are paid influencer promotions illegal?

Paid promotions are legal only if properly disclosed and genuine. Hidden endorsements or misleading claims can lead to legal repercussions.

Useful Resources and Links

- FCA ScamSmart Warning List

- FINRA Scam Awareness Resources

- Google Reverse Image Search

- SEC Investor Alert on Social Media Scams

Real-Life Example: Social Proof Scam Uncovered

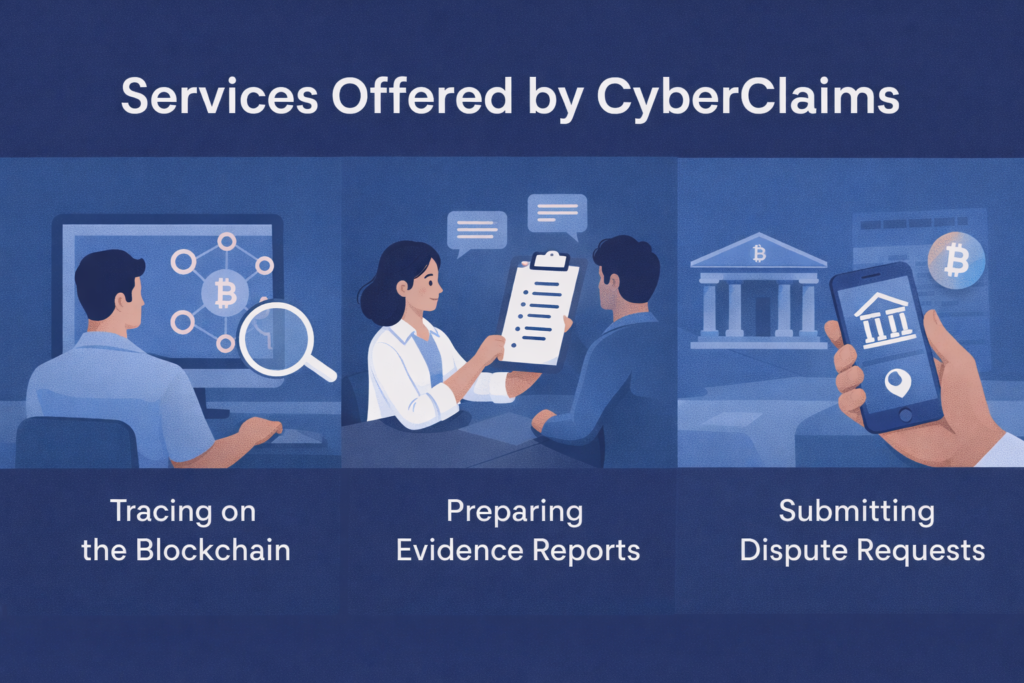

Cyberclaims.net helped a client uncover a fraudulent broker promoted heavily on social media with fake LinkedIn endorsements. By exposing the deception, the client successfully recovered approximately $30,000 through regulatory action and chargebacks.

Have You Been Deceived by Fake Social Proof?

If you’ve been targeted by scammers using deceptive social proof tactics, get expert recovery help today by contacting Cyberclaims.net.