Many people often prefer to acquire or partner with an already established business enterprise because they think it is cost-effective. The first thing that crosses most people’s minds when making such decisions is that the complex and initial setup works for such business enterprises have already been done, and they are in to enjoy profits.

Our focus here will not be on the numerous benefits of purchasing or partnering with an already established business enterprise; instead, we will look at the most vital part of this venture.

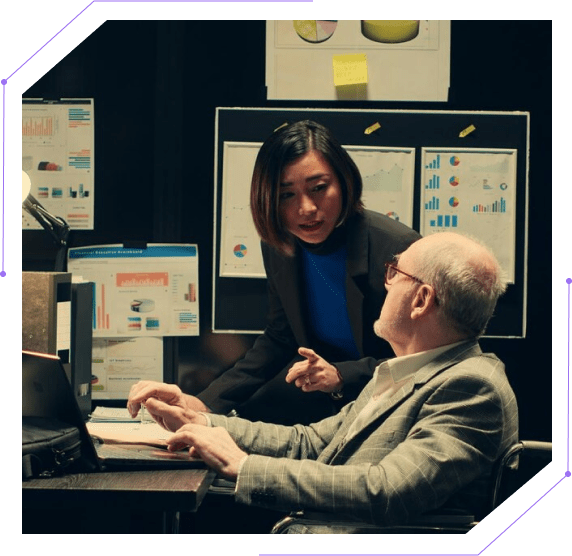

Due Diligence Investigation is the most important and delicate part of acquiring or partnering with an already established business enterprise. It determines the failure or success of acquiring or partnering with an already established business enterprise.

These are investigations carried out to investigate every potential financial and legal risk about a company’s assets. This is done to ensure that any form of investment is beneficial to the investors. A proper due diligence investigation procedure can protect you from venturing into the wrong business venture. This tells why you need to hire the best due diligence investigators for your investigation procedure.

Some key factors that are put into consideration while carrying out the due diligence Investigation procedure include:

In order to execute these tasks, Cyberclaims specialize in tracing the following types of information that would be of great help to the investigating unit:

Cluster analysis is a method that aims to deanonymize blockchain data, linking together different wallets belonging to the same user. This also enables one to determine whether any of the linked addresses have a UTXO.

This will aid the investigation processes by analyzing ownership attribution information for numerous accounts, also with the aim of deanonymizing blockchain addresses.

Through this, all cryptocurrency companies that comply with Anti- Money Laundering (AML) and Know Your Customer (KYC) regulations can get identifying information for their customers who own wallet addresses.

Cluster analysis is a method that aims to deanonymize blockchain data, linking together different wallets belonging to the same user. This also enables one to determine whether any of the linked addresses have a UTXO.

This will aid the investigation processes by analyzing ownership attribution information for numerous accounts, also with the aim of deanonymizing blockchain addresses.

Through this, all cryptocurrency companies that comply with Anti- Money Laundering (AML) and Know Your Customer (KYC) regulations can get identifying information for their customers who own wallet addresses.

Important company information that would help you make an informed decision about purchasing such a company. Some of the information includes:

Information about the company’s current and future products and services and how they compare to the company’s competitors.

This is very important as it helps you know the capability of the company’s customer base.

You get to know if the company owns any of these assets and how they would be utilized to your advantage.

Laws and regulations that apply to the company and its industry, insurance policies, litigation history, license of operation, etc.

Financial standings of the company such as gross profit margin, debt, future capital expenditure, etc.

When we say entrepreneurs, it means both buyers and sellers that are involved in a business acquisition deal.

From a seller’s perspective, due diligence investigations help the seller know more about their company’s financial information. With this, they can decipher the actual market value of the company that is about to be sold to make maximum profit from the sales.

From the buyer’s perspective, due diligence investigations help them to understand what they stand to gain or lose after a potential purchase. It gives them full confidence that they are moving in the right direction and have all the information needed to make the best purchasing decisions.

Having established that due diligence investigations services are needed by both sellers and buyers of a company, the question now should be how does one go about due diligence investigations procedures?

Worry no more, as Cyberclaims got you covered with our unparalleled due diligence investigation services.

When conducting due diligence investigations on a target business, our primary aim has always been to assess its affairs before making any final decision as to whether to carry on with the acquisition process. At Cyberclaims, we go the extra mile to ensure that you make the best decisions when you consider acquiring or partnering with an already established company.

How Cyberclaims operates to achieve the desired result involve:

Hurry now and contact us at Cyber Claims to enjoy the services of global experts in due diligence investigation.

Beware of Impersonators!

We have been alerted that individuals are impersonating CyberClaims representatives to deceive victims. Scammers may call, pretending to be us, and direct you to our site.

If you’re unsure, verify with us at contact@cyberclaims.net. Stay vigilant and stay safe