Learn to protect your investments from 2024’s liquidity mining scams. Identify red flags, research thoroughly, and trust CyberClaims for security.

The Rise of Liquidity Mining Scams: Protecting Your Investments

Liquidity mining has become a popular strategy for earning rewards in the cryptocurrency space. By providing liquidity to decentralized finance (DeFi) platforms, users can earn tokens and other incentives. However, the rise of this trend has also given way to a growing number of liquidity mining scams, putting investors at significant risk.

What Are Liquidity Mining Scams?

In a legitimate liquidity mining setup, users deposit their assets into a liquidity pool to facilitate trades on decentralized exchanges. Scammers exploit this by creating fraudulent pools or projects, often promising high returns to lure in investors. Once enough funds are deposited, these fake platforms disappear, leaving victims with no way to recover their investments.

Common Tactics Used by Scammers

- Fake Liquidity Pools: Fraudulent platforms mimic the interface and branding of legitimate DeFi projects, tricking users into depositing funds.

- Ponzi Schemes: Some scams operate by using new investors’ deposits to pay off earlier participants, collapsing once new funds dry up.

- Rug Pulls: Developers of fraudulent projects withdraw all liquidity from the pool, effectively stealing users’ funds.

- Unverified Smart Contracts: Scam platforms use poorly written or malicious smart contracts to exploit user funds.

How to Protect Your Investments

- Research the Project: Investigate the team behind the platform, their track record, and the project’s legitimacy. Look for reviews and community discussions on platforms like Reddit and Twitter.

- Check for Audits: Only invest in platforms with independently audited smart contracts. Audits help ensure the security and transparency of the platform’s code.

- Use Trusted Platforms: Stick to well-established DeFi platforms with a proven history of reliability and user trust.

- Be Skeptical of Unrealistic Returns: Scammers often entice users with promises of extremely high rewards. If it sounds too good to be true, it likely is.

- Monitor Liquidity: Observe the liquidity in the pool over time. Sudden, unexplained changes could indicate a potential rug pull.

- Protect Your Wallet: Never share your private keys or recovery phrases. Use a secure wallet and enable two-factor authentication for added security.

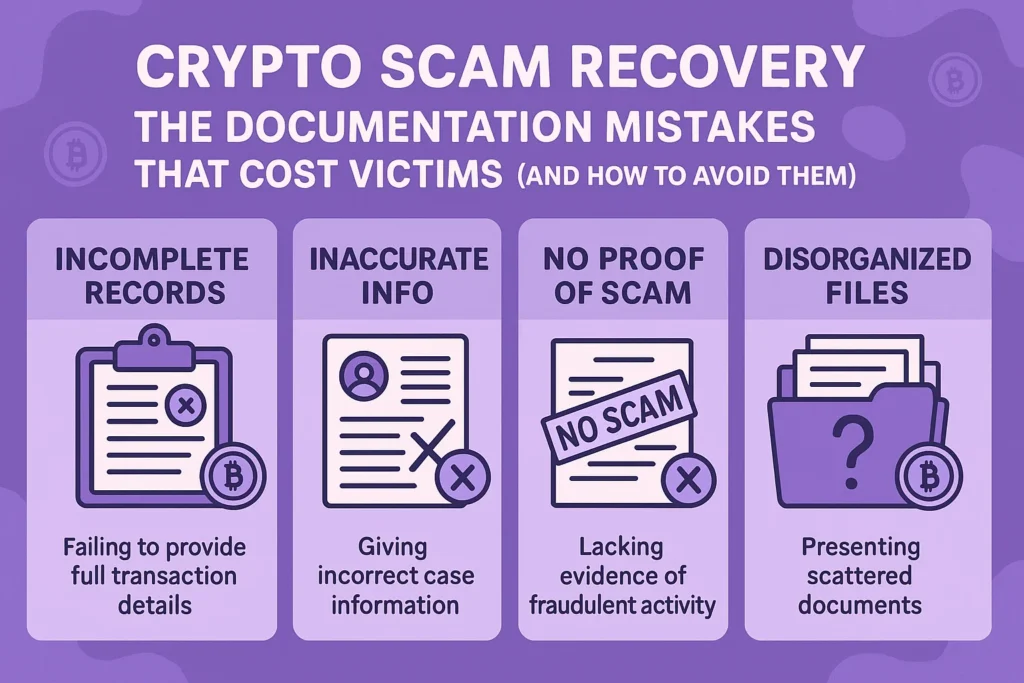

What to Do If You Fall Victim

If you suspect you’ve been targeted by a liquidity mining scam, act quickly:

- Stop All Transactions: Disconnect your wallet from the fraudulent platform immediately.

- Report the Scam: Notify the crypto community and relevant authorities to help prevent others from falling victim.

- Seek Recovery Assistance: Contact professionals like CyberClaims for guidance in recovering lost funds and securing your assets against future scams.

The Role of CyberClaims

At CyberClaims, we specialize in helping victims of cryptocurrency scams, including liquidity mining fraud. Our team uses advanced tools and industry expertise to track stolen funds, assist with recovery, and provide actionable advice for future protection.

Stay Informed and Vigilant

Liquidity mining offers genuine opportunities in the DeFi space, but scammers are quick to exploit unsuspecting investors. By staying informed, doing your due diligence, and exercising caution, you can protect your investments and navigate the crypto world with confidence.

With CyberClaims by your side, you can focus on exploring legitimate opportunities while we help safeguard your assets from the ever-evolving landscape of crypto fraud.